A unique gift.

YOUR OWN DRINK, YOUR OWN FLAVOUR

A UNIQUE CORPORATE GIFT

Together with you, we create your own unique drink.

An ideal gift for all your clients, colleagues, partners, and employees.

Your story in a bottle

GIVE YOUR OWN

SELF-CREATED DRINK

Want to impress with a gift? Your own custom drink always makes an impact:

- A bottle represents celebration, success, and enjoyment.

- Incorporate your company values into the recipe, the label, and the bottle.

- The team-building is an experience in itself—and afterwards, it’s even more meaningful to give a gift you created yourself.

- A beautiful bottle earns a place in the collection—even when empty.

From €26 per bottle

The price depends on the selected drink (gin, vermouth, rum, ...), the type of bottle, and the quantity. We require a minimum production of 42 liters or 60 bottles. With larger volumes, the price decreases.

WE MAKE IT EASY FOR YOU:

- Alcohol-free is also possible.

- We print directly on the bottle, in-house.

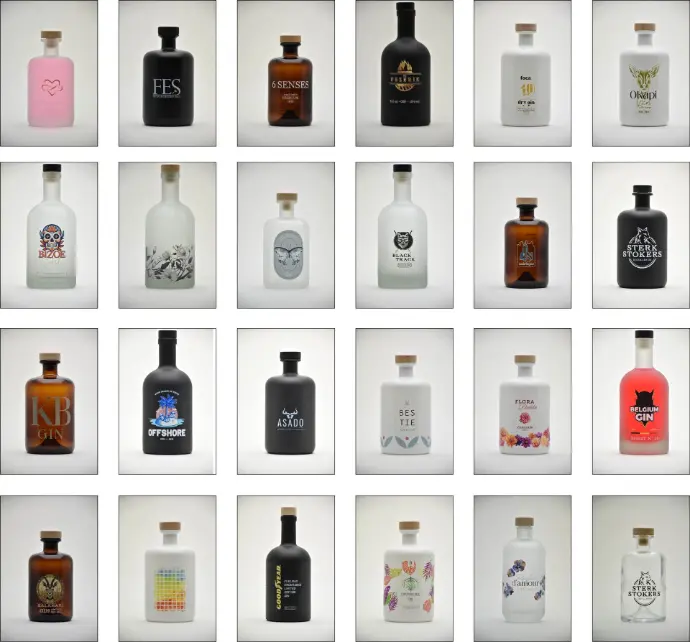

- Choice of over 40 types of bottles.

- More than 200 botanicals to choose from.

- Prefer a standard recipe? That’s possible too.

- Drop by and get inspired by previous projects.

- Personalized gift boxes, botanicals... we think along with you.

- Because we handle most of the process in-house, we have control over delivery times.

We print directly on the bottle using a special technique, or use refined labels.

Share your idea for the perfect corporate gift,

and together, we’ll turn it into something special.

CORPORATE GIFTS: are they tax-deductible?

In Belgium, gifts to clients or business partners are tax-deductible under certain conditions. A bottle of gin with a customized company logo can be considered a corporate gift, but some specific rules apply:

- Deductibility: Corporate gifts are, in principle, 50% deductible in corporate tax, provided they are considered professional expenses and not private ones.

- Advertising: If the gift is considered an advertising expense (e.g., personalized bottles with the company logo), it can be fully deductible as a marketing cost. This depends on the specific circumstances and how the gift is positioned.

- VAT: VAT on corporate gifts is not deductible if the gift costs more than €50 per item (excluding VAT). For gifts valued under €50, the VAT is deductible.

To ensure the gift is properly recorded and deductible according to current regulations, it is advisable to discuss these points with a tax advisor or accountant.

TEAMBUILDING: tax rules in Belgium

The deductibility of team-building costs depends on the nature and business purpose of the expenses.

Deductibility of team-building costs:

- Business purpose: Activities that promote team cohesion and a good work environment (such as sports, workshops, or training) are generally fully deductible.

- Relaxation activities: Luxury outings without a clear link to work may be only partially deductible, depending on the justification.

VAT deduction:

- Overnight stay: VAT on accommodation costs is not deductible unless linked to seminars or training sessions.

- Food & drinks: VAT on restaurant expenses is usually not deductible, with a possible 69% deduction in certain cases.

Ensure that team-building activities are well documented as business expenses for tax deduction. Discuss this with a tax advisor or accountant to ensure proper booking and deductibility.